Investors had a wild ride in the first quarter of 2021. During that time they saw the price of GameStop stock go from $17 a share at the beginning of January to a high of $350 a few weeks later before it plummeted back to $40 a share. By the end of the quarter, it closed just under $200.

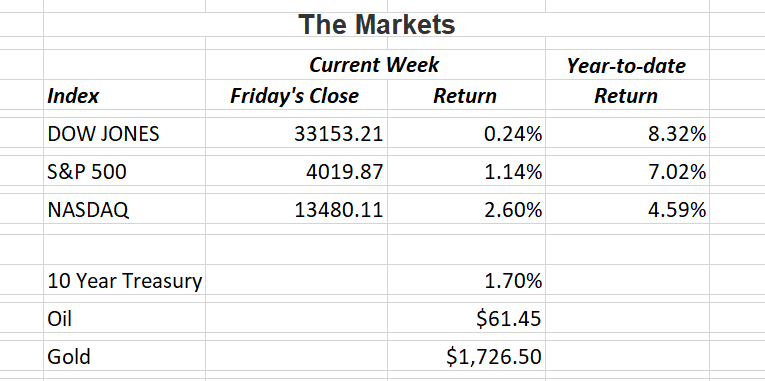

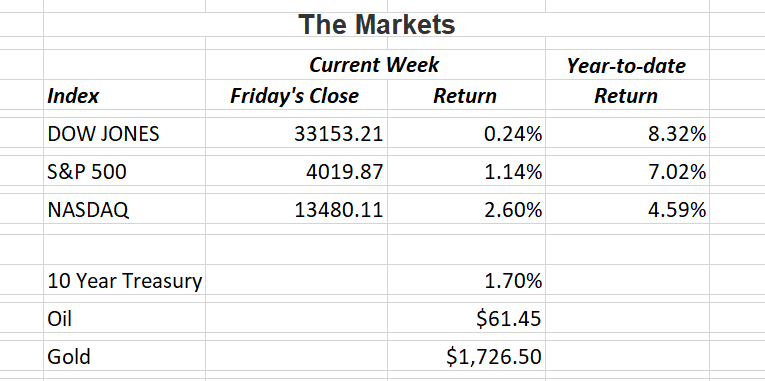

They also saw the Nasdaq underperform other major indices for the first time in several years. Last year alone the tech-heavy index posted a gain of over 43%. For the first quarter of 2021 however, it lagged the Dow Jones Industrial Average return of 7.76% and the S&P 500 return of 5.77%. The Nasdaq posted a gain of 2.78% for the first quarter.

A sharp rise in interest rates also caught investors off guard. The benchmark 10-year treasury note began the year just under 1%. By the end of the quarter, it jumped to 1.77%. Analysts believe much of the increase was due to heavy selling by Asian countries. Most notably Japan and South Korea as they adjust their financial plans for the rest of 2021.

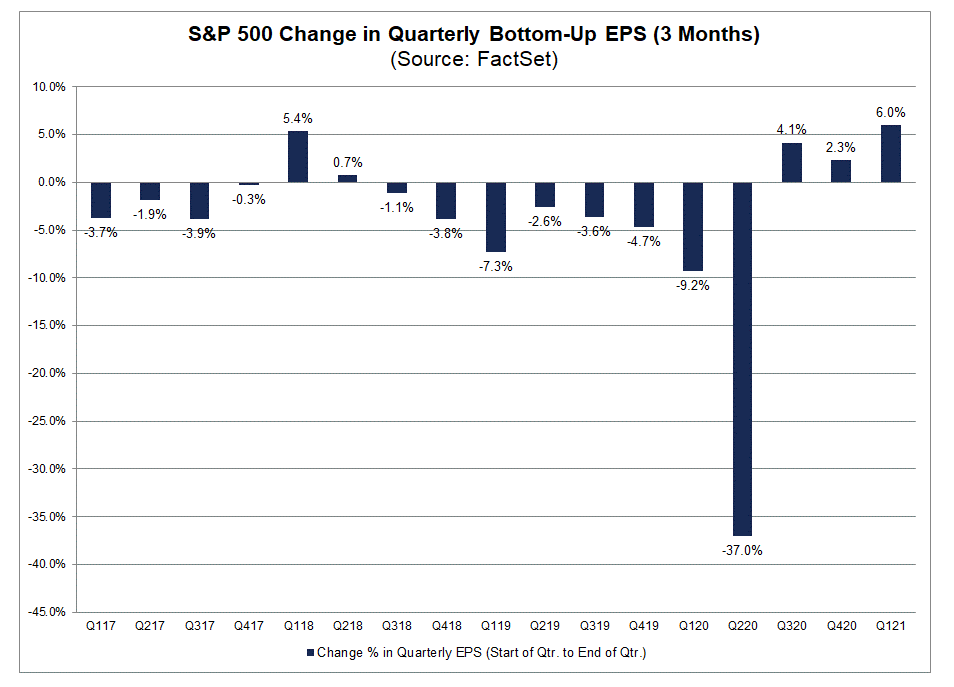

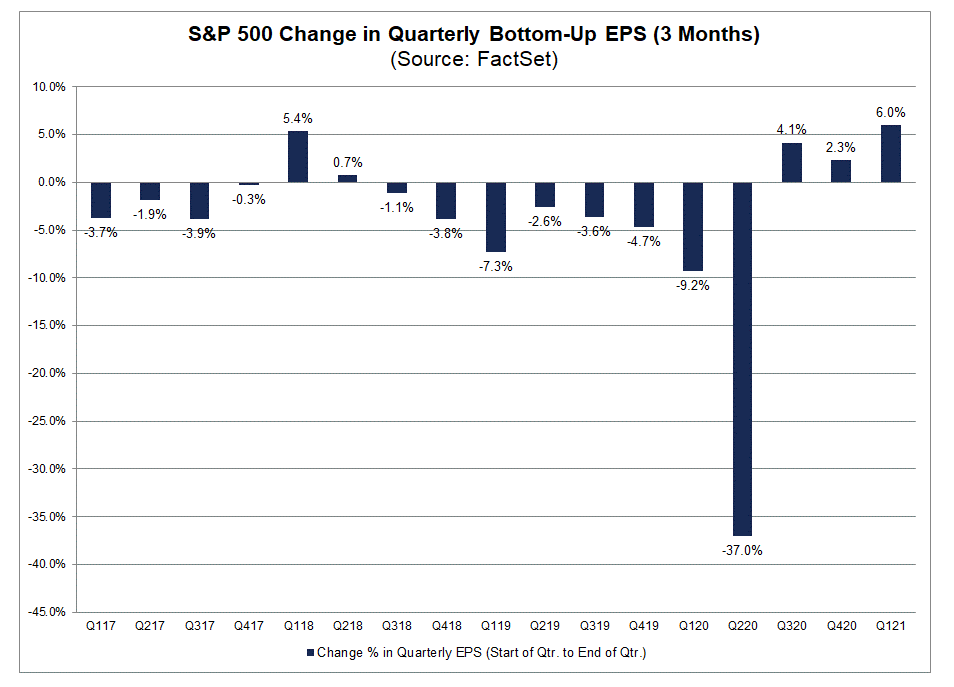

As we will soon be receiving earnings reports for the first quarter, we see a record-high increase in earnings estimates for the S&P 500. According to FactSet, earnings estimates for the index have grown from $37.61 to $39.86.

At the closing bell on Thursday, the S&P 500 closed above the 4000 mark for the first time.

If you have any questions, please contact me.

|

The Markets and Economy

- While the U.S. is open to trade negotiations with Beijing, President Biden isn’t ready to lift tariffs imposed by the Trump administration just yet. U.S. Trade Representative, Katherine Tai warned, “Yanking off tariffs could harm the economy unless the change is communicated in a way so that the actors in the economy can make adjustments”.

- Notes from the Fed’s meeting on March 17 shows the central bank anticipates no interest rate increases until at least 2023. The Fed also said they will continue to keep purchasing $120 billion a month in bonds until substantial progress is made for the central bank’s goals on inflation and the labor market.

- At a virtual event organized by the New York Fed and AARP, the Federal Reserve Bank President John Williams said; “I’m optimistic about the overall economy. We’re making great strides on the vaccination program…I think we have a lot of positives going forward”.

- Several large companies including JPMorgan Chase and PricewaterhouseCoopers are looking to unload big blocks of office space, the latest sign that remote work is hurting demand for commercial office space.

- As President Biden announced his proposed $2.3 trillion infrastructure bill last week, the American Society of Civil Engineers said it will take $2.8 trillion for repairs and upgrades to American roads and bridges over the next 10 years. Concerns in both chambers of Congress are mounting over the cost of the plan and the tax increases that go along with it.

- Housing prices across the U.S. are climbing at their fastest rate in 15 years. Low-interest rates and an extremely limited supply of homes on the market is fueling double-digit price growth across the country.

- The International Monetary Fund raised its outlook for the global economy in 2021 and 2022. Increasing vaccinations against Covid-19 and the U.S. government’s fiscal stimulus were cited as the main reasons for the IMF’s increase.

- OPEC and other top oil-producing countries agreed to boost their collective output by more than two million barrels a day over the coming months. The cartel anticipates an upswing in demand as the global economy recovers from the effects of the pandemic.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.

|